What is the Arizona Charitable Tax Credit (ACTC)?

What is the Arizona Charitable Tax Credit (ACTC)?

The aptly named ACTC is a tax credit that encourages Arizona residents to donate to their favorite charities by applying the amount of their donation to their income tax liability, thereby lowering their tax bill.

Who can participate?

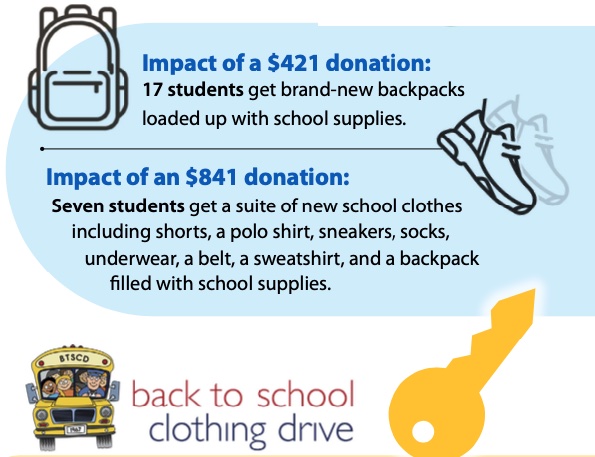

Anyone who pays state income tax in Arizona should be able to participate in the ACTC. The maximum credit that can be claimed on 2023 returns is $421 for single taxpayers and $841 for married couples filing jointly.

Why should I participate?

Why should I participate?

This incredible program means you can choose exactly where a portion of your tax dollars are spent! Because it is a dollar-for-dollar tax credit, you can give money to Back to School Clothing Drive each year without it actually costing you a thing! Because the money you donate to us is money you would owe to the state anyway – they just let you “pay” us instead of them!

How do I take advantage of the ACTC?

First, donate to Back to School Clothing Drive. Then, file your taxes and include AZForm 321. (Back to School Clothing Drive is a Qualified Charitable Organization identified by code 20462.)

When is the deadline?

When is the deadline?

Unlike other donations that have to be made by the end of the year, the ACTC allows donations made up until the federal tax deadline (usually April 15) to be claimed. This is especially helpful if you want to know your tax liability before you make your donation.

Where can I send my donation?

You can make a secure donation online at www.btscd.com/donation or you can mail a check to 360 E. Coronado Rd., Suite #200, Phoenix, AZ, 85004.

Still have questions? Follow this link to FAQs.